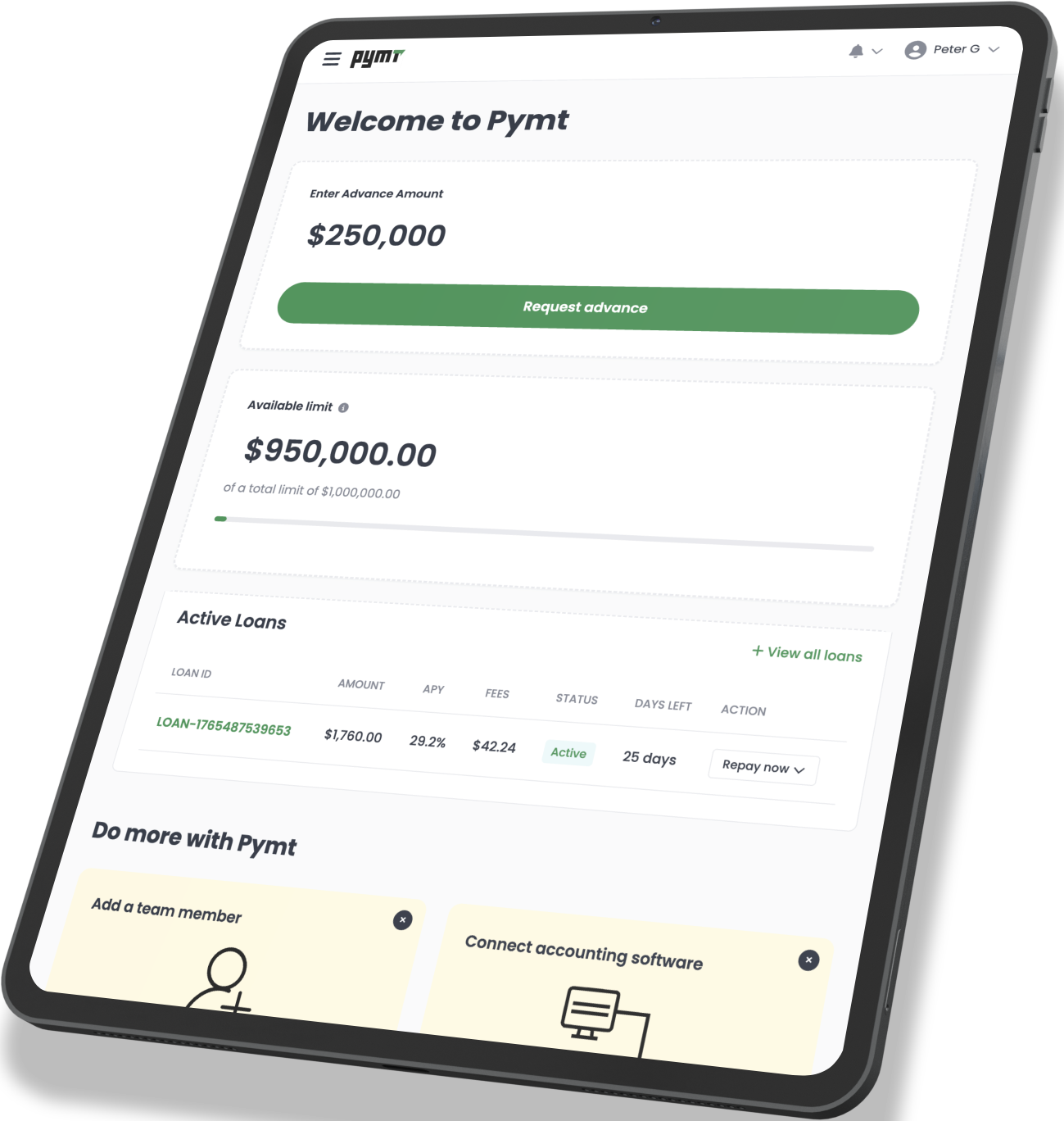

Powered by our powerful dashboard

Get instant capital, and monitor its flows, borrowing-base utilization, and portfolio performance instantly.

Our dashboard shows how much credit is available and which collateral can be used against it, lets you draw funds, and make repayments automatically.

No meetings, no calls, no humans in the middle.